BCLD Fund I, LLC

Targeted Real Estate Investing

▼ keep reading ▼

operations summary

BCLD Fund I, LLC will seek to acquire and manage high quality real estate assets with the intention of providing participating investors with a real estate focused investment opportunity that combines income, principal investment growth, and elements of capital preservation. The Fund will pursue both short term and long term opportunities with the majority of capital deployed into long term, lower risk asset acquisitions.

Target Markets

- Detroit, Michigan

- Atlanta, Georgia

- Washington, D.C.

Asset Sourcing

The Fund Manager engages with entities that control multiple properties, such as lenders, servicers, and operators, and seeks to locate assets in their portfolios that would be potential investment opportunities. Concurrently, the Fund Manager employs its value-add methodology that focuses on specific assets that it believes are distressed or are otherwise attractive investment opportunities.

Acquisition Criteria

- Property Type: Multi-family and Apartment Complexes

- Mostly class “A” and “B” properties with select “C” class property acquisitions possible

- Single-Family 2bd 1ba – 4bd-4ba

- Average Property Size: 05-12 units

- Estimated Average Age of Target Properties: 20-100 years old

- Deferred maintenance and rehabilitation expected on certain properties

- Detroit, MI, Atlanta, GA, and Washington, DC are primary target markets

- Ideal locations situated near public transportation, shopping, and employment centers

- At least 20,000 population or greater within a 3-mile radius

- Individual unit matrices with a large percentage of 2+ bedroom floor plans and individual electric meters

- Acquisition price less than 80% of Fair Market Value

- Upside rent and valuation potential from asset enhancements and re-positioning

Asset Re-Positioning and Marketing

Once any renovation required is complete, the Fund will proceed with re-positioning the asset and marketing the asset to potential rental consumers. The Fund expects that many of the properties acquired will not be in a physical condition or managed such that the asset is attractive to a rental consumer willing to pay an increased rental rate. In part, much of the re-positioning process occurs with the modernization of the property and the inclusion of aesthetic features that will appeal to the core target rental audience in the selected markets. The Fund Manager has extensive experience in rehabilitating properties such that they have significant rental appeal to a mid and upscale rental consumer. This increase in appeal allows for increased rental rates, higher expected net operating income, and equity accretion.

Disposition of Assets

Short Term Investments (under 18 months): The Fund Manager anticipates that thirty percent (30%) of capital from the Offering will be allocated towards opportunities that involve acquisition, reposition and/or rehabilitation, and asset disposition in under 18 months. Many of these opportunities will be sourced from distressed sellers or “special circumstance” type acquisitions (package Bank REO, seller joint venture, etc.) wherein a significant amount of equity and value is present from the time of acquisition and additional equity and profit is realized through the reposition, re-branding, and rehabilitation process.

Long Term Investments (3 to 5 years): The Fund Manager intends to allocate approximately seventy percent (70%) of invested capital towards acquisitions that will require a longer duration of time to mature prior to disposition. The Fund Manager expects that these assets will still be sourced at attractive acquisition rates, however the properties may not require as much rehabilitation or may be located in areas that demand a higher acquisition premium and thus the Fund Manager expects less initial equity immediately post-acquisition. Assets in this category will typically be held in the Fund’s portfolio for three to five years prior to disposition.

terms of the offering

$10,000,000

Minimum Offering: $1,000,000

Minimum Investment: $10,000 (10 Units)

BCLD Fund I, LLC (the “Company” or “BCLD”), a Michigan Company, is offering a minimum of 1,000 and a maximum of 10,000 Class A Membership Units for $1,000 per unit.

Distributable Cash, if any, derived from operation of the Company will be evaluated on a monthly basis, and disbursed as provided below until expended: Class A Members shall receive a total of eighty percent (80%) of the Distributable Cash and Class B Members shall receive twenty percent (20%) of any Distributable Cash.

Distributable Cash, if any, from a “Capital Transaction” such as a refinance or disposition of a Property, will be distributed as provided below until expended:

On refinance of a Property: First, to the Class A Members until they have received a return of one hundred percent (100%) of their Capital Contributions; then Class A Members shall receive a total of eighty percent (80%) of the Distributable Cash, and Class B Members shall receive twenty percent (20%) of any Distributable Cash.

On disposition of a Property: First, to the Class A Members until they have received a return of one hundred percent (100%) of their Capital Contributions; then Class A Members shall receive a total of eighty percent (80%) of the Distributable Cash and Class B Members shall receive twenty percent (20%) of any Distributable Cash. For the purposes of Cash Distribution calculations only, all Distributions from Capital Transactions such as a refinance, will be treated as a return of capital until the Class A Members have received one hundred percent (100%) of their initial Capital Contributions, after which any further returns will be a return on investment.

Management Team

The Company is currently managed by seasoned business and sector professionals dedicated to the success of the Company and efficient execution of its planned operations.

Jason Cole

Jason Cole

Manager of BCLD MGMT, LLC

- 10/08 – PRESENT Executive Director

- Michigan Minority Contractors Association formerly NAMC

- Real Estate Investor Association Detroit Chapter Facilitator

- National Association Minority Consulting Engineers Detroit Chapter

- Detroit Association of Planners

- National Association Black Women in Construction Detroit Chapter Collaborator

- National Organization Minority Architects Detroit Chapter

- Detroit Association of Realtors Member

- National Association Black Hotel Owners Operators Development

- 01/17-PRESENT Cole Development Group

- Development Partner with Basco Development in a 22room Boutique Hotel in Downtown Detroit.

- 01/15-PRESENT Funding Roots

- Crowd Capital platform that was formed to help Detroiters finance and redevelop Detroit through real estate and franchise opportunities (2012 Jobs Act and 2016Mile Act)

- 01/08 – PRESENT Commercial Financial Specialist LLC Vice President

- Develop and implement the business and strategic marketing plan for this existing Commercial Real Estate Lender.

- 07/05 – PRESENT Barno Cole Land Development Group LLC Vice President

- Covering the areas of; Human Resources, Financial, Marketing and Legal concern.

- 09/88 – 12/08 Cole Financial Services, Inc. Vice President

- Duties include; Marketing and Sales, Human Resources support, and Accounting and Finance lead for this Human Capital recruitment, retainment and placement firm.

- 06/98 – 09/98 U.S. Small Business Administration

- Economic Development Specialist

- Developed and implemented a plan for increasing the rate or African-American Loan Initiation in the SBA 7a lending program. The goal was to increase it by 300%.

CONTACT US

Please complete the contact form and we will get back to you about any questions you have about our offering.

BCLD Fund I LLC - 300 River Place Drive Suite 5350 - Detroit, MI 48207 — admin@bcldfundi.com — (313) 707-5007

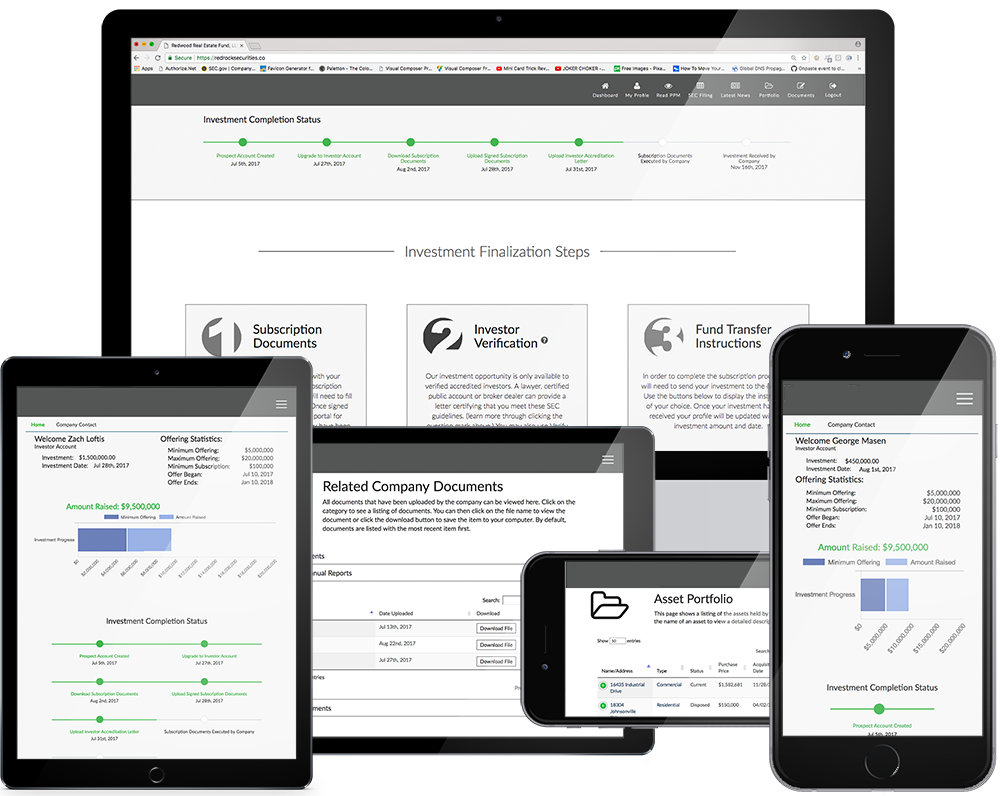

so much more than what you see

The BCLD Fund I, LLC Investor Portal provides the ability to learn about our investment opportunity. Once registered, you will be able to:

- Access to the Private Placement Memorandum, which outlines our company and gives greater detail about our offering;

- Access to our SEC filing;

- View real time offering metrics of how far along we are in the offering process;

- View a timeline of your progress in the subscription process;

- View company contact information - directly contact us with any questions;

- Easily upgrade your account with the click of a button to go through the subscription process.

Once your account is upgraded you will have additional tools including the ability to:

- Complete the subscription documents;

- Upload accreditation documents if applicable;

- Access instructions on transfer of investment funds;

- Access company documents including Reports, Financials, and Supporting Documents;

- Access the Asset Portfolio as applicable;

- View News articles written by the company;

- View and download documents associated with your account.